With 2021 behind us, we wish you the full optimism, energy, and momentum that comes with the arrival of a brand-new year! We have been updating and sharing with you this list each year as a matter of tradition. We are convinced that real estate should be the foundation of your financial security. Does real estate figure into your 2022 New Year’s resolution? Here are some suggestions for consideration in your real estate related resolutions:

1) Buying Your First Home: Homeownership is the quintessential American dream and is also the top goal of most Millennials. Homeownership represents the foundation of personal freedom and the major source of savings for most Americans. Since we all need a place to live, we can either rent or we can own. Owning is the first step to building equity and financial security. Many have built their wealth through it. However, owning a home does come with a lot of responsibilities and isn’t for everyone. The price escalation of the last 2 years has also made that starter-home dream elusive for many. Are you ready to take this step in 2022 for your financial future? We can help you get started.

2) Selling: Do ever-changing priorities and plans make you think about selling your home? Is it time to re-evaluate your investment properties? The significant price appreciation over the last 2 years has many homeowners considering making a change. Increasing property taxes, insurance premiums, maintenance costs, and potential capital gains tax changes, have some investors considering cashing out. In this fast-changing market, it’s important to have a professional consultation when thinking about selling. During seller consultations, one very important question we answer is when to act. In a rising market, time is on the Seller’s side. In a declining market, sooner is better than later. We watch and analyze the market closely and are happy to share with you our insights so that you can make the most informed decision.

3) Change of Lifestyle: Our needs and wants change over time, and where we live can affect the quality of our lives. The stay-at-home months of 2020 highlighted the importance of our homes. They have become the sanctuary where we live, work, and school! Do you dream of a different type of property or location? The ideal home is different for everyone. We’ve helped a family move out of a rigid HOA community and into a custom home on acreage. We’ve helped a family build their dream home on a lakefront lot where they watch sunsets over water and ski to their hearts’ content. We’ve had clients that moved to bustling Downtown Orlando, trendy Milk District, scenic Winter Garden, beautiful Winter Park, and oak-shaded Winter Springs where they experienced a renewed exuberance and excitement over everyday living. We have so many of these stories and continue to be passionate about homes and what our homes can do for us. We are partners in many of our past clients’ lives because we know how to help them make these transitions. Have you been thinking about something different? Let’s explore together.

4) Upsizing: Is your current home getting too tight? Do you have a growing family? Do you need an office? The average move-uppers purchase a home 1.5 times larger than their current home. For example, they move from a 2,000 to a 3,000 Sq Ft home. When the 3-car garage of our previous home became filled with storage, we knew it was time to upsize. Moving to a larger home now has increased my family’s quality of life in every way. It also made our quarantine much easier in 2020. We are happy to have made the move and will be happy to help you too.

5) Downsizing: Some of us are, or will soon be, empty nesters. Do you have empty rooms or a pool that is never used? Is the maintenance of a large home getting tiresome? Most homeowners downsize to simplify or lower the cost of living. A common theme is to purchase a smaller home outright with the equity from the selling of the current, larger home. Many may also downsize not necessarily to reduce cost, but to increase the quality of life, purchasing smaller homes in more desirable areas or into a newer, more upgraded home. We can introduce new, special communities to you.

6) Vacation/Second Home: If you’ve grown weary of spending your vacations in hotels and rentals, consider joining the nearly one million buyers across the country that purchased a second home last year. This is a dream for many people. After the hustle and bustle of a busy week, imagine a relaxing weekend at the beach or the “lake house” to recharge yourself. Some clients have also shared success stories of renting out their properties through services such as Airbnb and Vrbo.

7) Real Estate Investing: It has been said that the majority of the wealth in the United States has been made in real estate. There are many facets to real estate investing. We have worked with different investors over the last 20 years, from young couples fixing up one small home at a time, to sophisticated investment groups that purchase dozens of properties. Among our past clients, their goals have included portfolio diversification, capital preservation, cash flow, and equity appreciation. Two things that can make real estate a truly unique investment vehicle is the amount you can leverage (borrow) and the fact it can generate income. If a home is purchased with a 20% down payment and the rent pays the mortgage, that is an 80% leverage! Also, the fact that real estate can generate rental income sets it apart from most other investments. For most other investments to be profitable, they have to increase in value. Real estate can be a win even if the value doesn’t go up. With the current investor interest rates still so low, it is still a great time to buy. We have been real estate investors ourselves for many years and we are happy to share with you our personal experience.

8) Retirement Plan: Some of our clients apply the principle above as their retirement plan. They purchase properties whenever possible with the goal that upon the mortgage payoff, the rental income can support or supplement a comfortable retirement. We have been on this course personally for over 10 years now. It’s never too early, or too late, to start!

9) College Savings Plan: Is there a newborn or a young child in your own or extended family? Consider buying a rental home for the benefit of the child. Let’s say you can do it with 20% down and a 15-year mortgage. When the child is 15 years old, the property will be paid off. It can be sold for college tuition or other financial needs. Or, the future monthly rental income can help cover the child’s expenses. Even with a 30-year mortgage or other configuration, it is a significant head-start for your loved ones. Or, what if your kid is already heading off to college? Many parents have purchased rental properties around UCF for their kids and rent out extra rooms to roommates, which pays the mortgage. Our daughter will be going to law school in 2 years. We already know which property we will use to fund her education!

We sincerely wish you a happy, healthy, and prosperous new year. As always, if you have any real estate related questions, give us a call! We are happy to discuss real estate topics even when it’s not business. Also, we love referrals!

Until next month,

2021 is winding down to its final month. We, the Yao Team, want to express our gratitude for your support for another amazing year. The central Florida real estate market has seen incredible ups and downs in the last 20 years. Our own community has seen its own share of fluctuation and challenges in that time. Now, at the end of 2021, our housing market stands stronger than ever. The desirability and soundness of home ownership is also more evident than ever.

We hope to have the honor and privilege to be a guide and partner to your real estate journey in the coming year. Happy Holidays!

Happy November! We hope you are enjoying the cooling weather as we approach the beginning of the holiday season! We’ve been asked by a lot of homeowners this year about investors wanting to purchase their homes directly. We will summarize our discussions below.

Home Sellers:

If you are a homeowner, you may have received solicitations from various companies and investment groups wanting to buy your home directly. We can relate. Personally, we get direct mail, phone calls, and texts from multiple parties EVERY day! Also, as real estate professionals, we are contacted all the time by wholesalers and home-flippers looking for this kind of opportunity. We have written extensively in the past as this buy-and-flip industry started and evolved. It is a fast-changing industry and a big business. There are large Wall Street backed companies as well as small privately funded groups. Their approaches and strategies continue to evolve with the changing market. But one thing remains the same: They are in the business to flip your home and profit from your choice to bypass the open market.

Sometimes these flip-investors can make very attractive offers. Here is an industry insider tip: If your home is not at the high end of your neighborhood/market and meets certain criteria, you don’t really know how high it can fetch in the open market. Our traditional methods of property valuation are solid in a traditional market. In a market where the demand is higher than the supply, we have been consistently achieving sale prices above market value. This is a pleasant result for our sellers but not really an “unexpected surprise”. The flip-investors also know this. That’s why they can sometimes offer “market value”, when they know they can sell it for higher later. The bottom line is, if you want to walk away with the most money, you will achieve it in the open market, where the buyers compete. Selling to one party, without competition, is when you will leave money on the table. We see this when homeowners sell their homes directly to their family members or friends without listing them on the open market. In those cases, there is the relationship factor. But, you have no relationship with those flip-investors. They have algorithms to help them calculate their maximum profit. You need to look out for yourself.

Some homeowners asked about the “convenience factor”. That is pretty much the ONLY angle of the flip-investors. They claim to offer fast and convenient closings. Actually, these flip-investors will absolutely evaluate the property and make sure they are making a good investment before they would close on the purchase. They promote the idea that selling your home is difficult and scary, so you will sell to them. How much money are you willing to forfeit to go this route? As real estate professionals, our business is to make the home selling process easy for our clients. The testimonials from many of our clients repeat the comment that we made the process smooth and easy. Most of the time it is not harder than selling to flip-investors. Most people only sell a few homes in their lifetime. Make sure you do it right! Talk to us first. We will help you evaluate your best options!

Until next month, take care!

Happy October! After another long, hot, and humid summer, we are finally in the season of fall. We hope with the change of season, you are refreshed, renewed, and prepared to finish this year strong.

Continuing the trend from 2020, the housing market in 2021 to date was red hot again. We’ve seen prices of many consumer products go up due to short supply. The housing market is no different. Low inventory and high demand resulted in price escalation, most significantly in entry-level homes, which cannot keep up with the growing population and the high rate of household formation. It has become increasingly difficult for our younger generation to buy a home. Some cities are experimenting with zoning changes to allow higher housing density, and other creative ways of reducing cost of homes. I hope together we can work towards making this American dream accessible to all that desire it.

Why is homeownership so desirable? We usually focus on the myriad of financial advantages, while there are also more personal perspectives. For some, homeownership is a milestone, an accomplishment in life. For others, it’s about security and having a sanctuary. This post below captures that sense of security and belonging in a simple yet profound way.

For some, it is an investment of not just money, but also the loving attention paid to creating a place of their own, with people they love.

“Years from now, when we fix up our own home together, I’ll recall the night we wandered through Home Depot and spent 20 minutes in the doorbell section listening carefully to each one.”

Of course, homeownership is not for everyone. Some may prefer the flexibility and freedom to move at will and not be tied down to a single home, neighborhood, or even a city or state. Some also prefer not to take on the responsibility of owning and maintaining a home.

If you do want to be a homeowner, make sure you are fully informed and prepared before embarking on this major undertaking. We are seasoned real estate professionals who have partnered with many homebuyers to help them achieve their dream of homeownership. We can do the same for you!

Until next month, take care!

Happy September! The back-to-school activities occupied many of us during the month of August. We moved one child back to college, and helped another return to high school. Morning traffic and school buses are back!

This is a major reason that there is typically a seasonality to the residential real estate market. Families tend to buy and sell homes when they are less preoccupied with other activities and have time to focus on the move. The buying and selling activity peaks in June and July, levels off in August, takes a breather in September and October, then ramps up again towards the end of the year.

2020 was not a typical year. The pandemic-driven demand kept the market busy all of the months after the summer season. Starting with the spring of 2021, the market activity reached a fevered pace and lasted through July. A lot of closings took place in August but new activities seem to be normalizing. There are more listings now and fewer buyers. Make no mistake, we are still in a strong seller’s market. But things are slowly trending towards a balance. It remains to be seen how the rest of 2021 will turn out.

We have had the pleasure and privilege of meeting many new home buyers this year as well as in 2020. They were the reason we had such a robust housing market. Who were these buyers? Let’s take a look at the Florida Realtors’ latest report.

According to Florida Realtors’ latest report of 2021 Profile of Home Buyers and Sellers in Florida, our home buyers are older than the national figures: One third of Florida home buyers are aged 65 or older. 9% of Florida home buyers bought because of retirement. The median age of Florida home buyers is 56. They tend to be repeat buyers. Only 23% were first-time home buyers, with millennials (age 25-40) leading that group. 3% of home buyers were Gen Z (age 18-24). Congratulations to this group for achieving the quintessential American dream of home ownership so early!

61% of these Florida home buyers were married couples. 21% were single females. 9% were unmarried couples. 8% were single males.

Of all buyers, 85% were born in the U.S., and 15% were born overseas. Among first-time home buyers, 73% were born in the U.S., and 27% were born overseas.

76% of them purchased an existing home, while 24% purchased a new construction.

2021 has been a challenging year for home buyers so far, because of competition with other buyers. The price escalation may have reached maturity in some market segments. We will continue to report on the latest market developments. As always, give us a call if you have any real estate questions. We love talking with you!

ORLANDO, Fla – When it comes to housing, there’s no denying that the U.S. is currently experiencing a seller’s market for the ages – but there’s some confusion about the underlying reason.

We’ve all heard the stories. Tearful would-be homebuyers being outbid at every turn. Their frustrated and exhausted agents turning the town upside-down, trying to find the next listing before it’s gone.

The struggle is real, and the data backs it up.

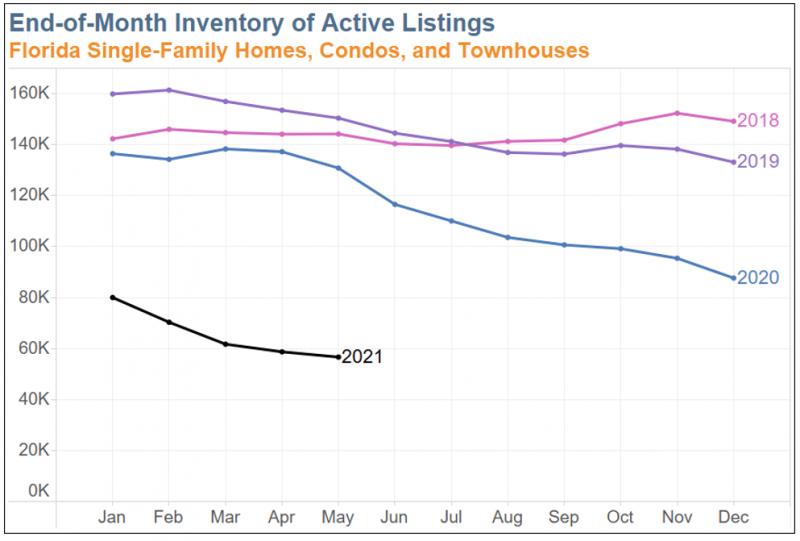

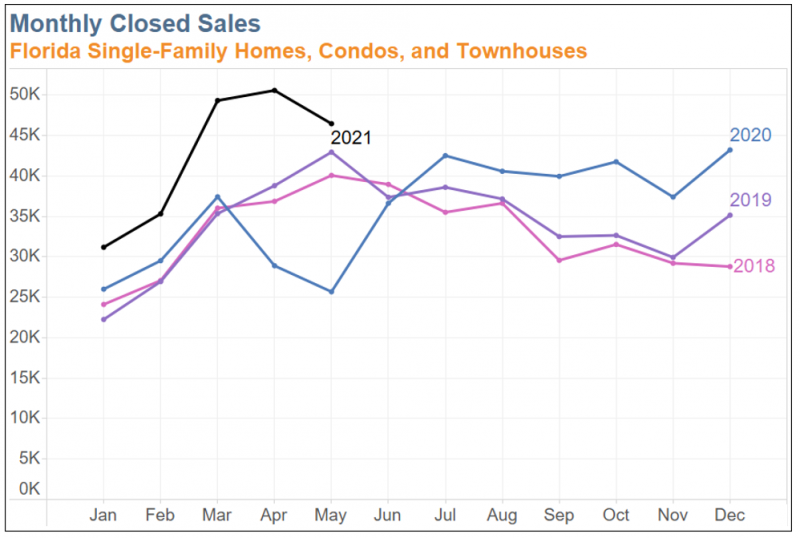

Here in Florida, there were only about 60,000 active listings of homes for resale as of the end of May. That’s a roughly 56% decline from the more than 135,000 homes on the market just one year ago, at the end of May 2020.

It also happens to be the lowest level of inventory ever reported by Florida Realtors Research Department, whose statistical records extend back to January 2008. The department calculates monthly resale market statistics from data provided by Florida’s numerous multiple listing services.

This decline in resale inventory is not unique to Florida, either. Recent housing market commentary from nationally prominent real estate analysts and economists has zeroed in on the low inventory counts being reported all around the country – and rightly so.

Unfortunately, though, this laser-like focus on inventory levels – along with all those vivid stories of buyer hardship – has given rise to a broadly held belief that significantly fewer homes are being listed today than before the pandemic.

As it turns out, that’s not really true.

Inventory is simply not a good measure of how many homes are being listed for sale. When it falls from one month to the next, it only means that fewer listings became active compared to the number that became inactive. A home going under contract affects inventory just as much as a home being listed for sale.

Most housing market commentators have been so busy telling you about our shockingly low inventory that they’ve forgotten to mention (or haven’t noticed) what’s going on with another key statistic: new listings of properties for sale.

Well, here’s what’s been happening with new listings. From January through May of this year, more than 246,000 existing homes were listed for resale in Florida.

That figure should raise some eyebrows. It is quite close to the roughly 250,000 and 248,000 properties that were listed during the same period in 2018 and 2019, respectively. And with the exception of those two years, it’s the largest total recorded for the first five months of any year dating back to at least 2008.

In truth, apart from a bad April last year (30% fewer new listings than in April 2019), the number of properties coming onto the market each month wasn’t substantially different during the pandemic than what it was pre-pandemic.

The count for July through December last year – over 263,000 – actually set a record for the second half of any year, coming in about 10,000 listings above 2018’s tally.

This trend has been visible for months now, not only in the statewide data, but also across local markets and different property types. And local data from markets elsewhere in the U.S. also reflect this trend, indicating it is happening nationally, not just here in Florida.

So why, then, is our inventory so low? Because all these homes being listed are selling – and selling fast. We’ve obviously had more closings so far this year than in the early months of last year due to the onset of the pandemic. But we’ve also had 28% more closings than during the equivalent period in 2019. Half of the sales that closed this May were only on the market for, at most, 12 days before going under contract. In May of 2020, that figure was 34 days. In May 2019, it was 44 days.

At this current rate, a lot of homes being listed aren’t even showing up in the end-of-month inventory figures. They’re going under contract before they can be counted.

The bottom line: Our inventory has been eaten away by a huge influx of buyers motivated by record-low interest rates and a pandemic-driven desire for a change of residence – not a decline in new listings.

A useful analogy is to think about an empty shelf at the grocery store. That shelf might be empty because the store stopped getting shipments of the product that goes on the shelf. On the other hand, it could be empty because demand has dramatically increased for that product and the shelf is being picked clean as soon as it gets stocked.

The latter scenario is a better description of our housing market right now – and that’s the better scenario. If inventory were instead falling due to a lack of new listings, there would be nothing to sell. Sales over the past year would have been down in a very big way, not marching at the record pace they have been.

Now, are there constraints that are keeping the number of new listings from rising to meet this elevated level of demand? Absolutely. We want to have a lot more new listings than normal right now, and we’re not getting them. That’s why it’s still accurate to call this a housing shortage.

At least, though, we’ve been getting enough listings to accommodate a huge expansion in the number of sales. This expansion has put the housing market at the forefront of our economic recovery.

That’s something we can all take solace in, even if it is cold comfort for all of those prospective buyers waiting to pounce on the next listing that pops up.

Brad O’Connor, Ph.D. is the Chief Economist for Florida Realtors

© 2021 Florida Realtors®

Happy Month of June! It’s amazing how time flies. Schools are out and we are approaching the midpoint of the year already! As much is happening around the country and the world, our focus remains on the local real estate market.

This month, we will share with you some talking points at our Yao Team meetings. If you have any questions or comments to share, please email us at Info@TheYaoTeam.com. We love talking about real estate.

According to Orlando Regional Realtor Association, a total of 2,655 listings for sale in April this year compared to 7,659 for the same month last year. Understandably, last year’s figures were heavily impacted by the COVID-19 pandemic. But after a temporary pause, the trend of heavy demand on limited supply started and accelerated through the rest of 2020 and in 2021 to date with no sign of slowing down. We have more buyers than there are good homes out there. So we work together strategically through careful selection, mixed in with some new constructions, to help our buyers find the right home.

From homebuyer inquiries on our listings to renter inquiries on our own rental properties, we are seeing a lot of relocating families from different parts of the country. A common theme is that during the pandemic, many people found that their jobs allow them to work virtually from anywhere. The famous sunshine and open space in Central Florida continues to attract newcomers, boosting the local economy and adding to the housing demand.

With the high demand and resulting rise in home prices, many worry that this might be a repeat of the housing bubble of 2006. We remember 2006. At that time, the high demand was driven by rampant speculative buying by people who couldn’t afford to carry the loans over time. There were buyers that bought one home after another and we were surprised that they were able to continue to get loans. It is different this time. According to Morgan Stanley, risky mortgage products, such as loans with introductory periods, teaser rates, or balloon payments, comprised about 40% of the mortgage market between 2004-2006. Those factors are now at only 2% of the mortgage market. Our own experience in the last 10 years with our buyers and buyers of our listings, is that they have strong credit and financials.

With the changing supply chain after the pandemic, there seems to be a shortage of many home-related items and shipping delays, not to mention skyrocketing material prices that increase the cost of remodeling projects and new constructions. We are learning that patience is a virtue, and a necessity, in this market!

In any seller’s market, stories abound about how “easy” it is to sell a home. We can tell you that experience and expertise are still crucial in achieving optimum outcome for our home sellers. Buyers are “brainstorming” on how to beat out the competition and achieve a contract. In fact, we are on a panel to teach techniques to real estate agents on this. Know that not all sellers with stories of receiving multiple-offers end up closing with the best price or terms. We scrutinize every detail of an offer and proposal, strategize the best plan to bring a contract to a successful closing, counter unreasonable demands, and negotiate the best outcome from the beginning to the end to ensure everything important to our sellers is achieved without compromise.

We will stop here. As always, we welcome your questions and comments. Until next month, take care!

The Yao Team

Happy month of April! We hope you are enjoying Spring. The Orlando real estate market is still going strong. While rising rates could potentially slow the pace of home sales, rates remain relatively low by historical standards. Record-low inventory is continuing to put upward pressure on home prices and creates challenges for buyers. If you are still in the market to buy or sell a home, give us a call without delay! We will provide timely insights which you may find helpful.

Q: I have made offers on several homes without success. What will help me in a multiple-offer competing situation?

A: We can completely sympathize with your frustration. If you are currently looking to buy a home below $300,000, the competition can be fierce. If the home is well presented and priced properly, your chance of competing with other buyers in a multiple-offer bidding situation is very high. Although there is no magic bullet that can guarantee your offer is accepted, we can share with you the factors that sellers consider when they are choosing among multiple offers.

Basically, sellers are looking for the highest net price and the smoothest transaction, with the least amount of hassle and uncertainty. So keep these factors in mind when you structure your offer.

Price: This is the first item a seller looks at. Not just at the offer price, but the net price. If you ask the seller to pay for things such as your closing costs, a home warranty, repairs…etc, these will be deducted from the offer price and make your net price offer less competitive.

Financing: The seller is looking for assurance that a buyer will successfully obtain loan approval to complete the purchase. There is nothing more frustrating for a seller than to wait 30 days only to learn the buyer’s loan is denied. Because of this, cash is most preferred. A Conventional loan is next, with more down payment the better. Whatever your financing type or terms, be sure you have a strong pre-approval letter from a reputable lender. You want to show the seller you can get the loan and close on the house.

Escrow Deposit: This is also called good-faith money. This shows the seller how much you are willing to forfeit if you do not come to the closing table. An offer accompanied by a small deposit is considered not serious. You want to show the seller you are serious.

Closing Date: The seller is looking for a date that works the best for their situation. Your flexibility to accommodate the seller’s needs can work in your favor.

Contingencies: These are conditions under which a contract can be canceled. More contingencies you build into your offer, less certain the closing looks to the seller.

Concessions: Make your offer as “clean” as possible. Don’t ask for things that are not vital to you. Concessions can be items such as a washer and dryer, or requests such as “refinish the pool surface”. Between two similar offers, the seller often chooses the one that asks for less.

Offer Presentation: Be sure your offer is presented in the most professional and timely manner. We regularly receive offer packages that are incomplete or incorrect. Make sure your offer has a correctly filled-out contract, all required forms, as well as a valid pre-approval letter.

Finally, there is nothing more frustrating than to learn the seller has chosen another buyer, while you’re holding back your top offer for that home. Remember a seller is not obligated to respond to offers in the order they come in. In a multiple offer situation, you may not get a counter-offer or a chance to improve your offer. You may want to consider making your highest-and-best offer upfront to beat out the competition.

Of course, these are very general tips. Each of these can be an article on its own. They interact on multiple levels in a negotiation. Your agent truly matters. Having the right representation is crucial. We work hard for our buyers. We reach out to the other party and discuss how to structure a win for our clients.

Best of luck to you. Hope you will achieve contract and be in your dream home soon!

We continue to experience a lot of “lateral movement” in our marketplace. This is when a homeowner sells a home and moves to another that better suits their needs. This is a sign of a maturing market because it indicates that homeowners feel it is both a good time to sell as well as a good time to buy. We have helped many clients do this successfully.

After a number of years in the same home, some clients have new additions to their families and need a larger home. Some clients are empty-nesting or retiring so need to downsize. Some are relocating to meet changing work and lifestyle needs, while others are simply ready for something new.

Buying a home is a major task on its own, something that most people only do a few times in their life. Adding to it the task of also selling a home at the same time, and it can become very daunting. Often it is difficult to make a change without knowing how it can be done.

We provide solutions to our clients to help them achieve this successfully. No two situations are identical. We custom-tailor plans depending on each family’s unique circumstances. Here are a few ways that a lateral move can be approached:

For most, the preference is finding the new home first. That is the main driving force for the move after all. There are many advantages to going this route. For clients who were able to purchase first, they moved into the new home and turned the prior home to us to market and sell. They didn’t have to deal with showings and related hassles. This is the easy route. However, this requires having the funds to purchase the new home, or the ability to qualify and carry two mortgages, or other creative financing options such as a bridging loan.

For many, the selling of the current home must happen first to obtain the proceeds for the purchase of the next home. This can be done several different ways, such as:

There are many more permutations of how lateral moves are accomplished. It’s helpful to have the same team involved in both sides of sale contingency transactions to oversee the process in its entirety. Despite the difficulty of lateral moves, our team has the experience and capability to handle these transactions and have done so many times over.

Give us a call for a personalized consultation. We will discuss the best strategies for you!

Until next month, take care!

Your Neighbors in Stoneybrook,

Happy February! The first month of 2021 is already behind us! We hope you’ve had a great start to the year and are well on your way to accomplishing your goals.

If your goals include selling a home this year, then this article is for you. And if you know anyone who is thinking of selling, please share this information with them, we’d love to give them the advantage with these great tips! If you are thinking about buying a home, stay tuned for next month’s article, or better yet, give us a call today!

The Orlando housing market has seasonal momentum, and real estate sales really heat up during the Spring-Summer seasons. For this reason, many sellers try to list during these peak months. If you want to sell quickly, for the highest possible price, then now is the time to start preparing your home! More prepared the home is, the better the outcome of the sale. The following are our best tips for things you can start doing today to prepare your home for the market.

This is the time to catch up on “deferred maintenance”. If your exterior walls show color deterioration, visible mortar lines, or feel chalky to the touch, it is time to repaint them. If your carpets are old and worn, you may want to replace them. Basically, to achieve the highest price when selling your home, you want it to appear well maintained and move-in ready. Anything you don’t want to bother with fixing, will be fixed by the buyer eventually but will be reflected in the sale price. Our experience indicates that buyers frequently deduct 2-3 times the actual cost of many repairs to account for the trouble and the unexpected.

Do you have unusual paint colors you know is a personal preference and may be an “acquired taste”? This is the time to neutralize those colors. Do you have outdated features or fixtures? If they are inexpensive we may recommend that you update them. For example, the older round bulbs in bathrooms, aka “Hollywood lights” can be inexpensively replaced with modern light fixtures. Sometimes, more expensive upgrades may be worthwhile before selling your home. For example, if you have outdated Formica kitchen/bathroom countertops, you may get full return or more for your investment if you upgrade to granite or other more popular countertops. Talk to us first before committing to any project. We can share with you the latest market trends and buyer preferences.

There are probably some pieces of furniture and other items in your home that you are tired of. There’s no reason to move them to a new home, just get rid of them now. Also, pack up as many personal items as you can. It can be difficult for potential buyers to picture themselves in the home if it is full of your family photos and memorabilia. Remember: Less is more.

Overgrown landscaping? Time to trim it back. Dead patches of lawn? Time to fertilize and water. Weeds in the flower bed? You know what to do. Save re-mulching until right before listing your home. It will give the yard a fresh look for photos and showings. Also, a good power wash of the front walkway and driveway can do wonders for the impression of your home.

We can help you look up the permit records for your home. If there are open or expired permits, you can work on closing them out before listing the home so they will not cause issues during the contract or delay closing.

Of course, this is not an exhaustive list. It is always helpful to give us a call first. We can evaluate your home and prepare a detailed, customized plan to prepare your home. We can even provide resources to help you get the work done.

Until next month, take care!